The financial services industry’s confidence in the UK’s economic prospects has fallen to its lowest level since 2012, the latest Chartered Institute for Securities & Investment (CISI) survey has shown.

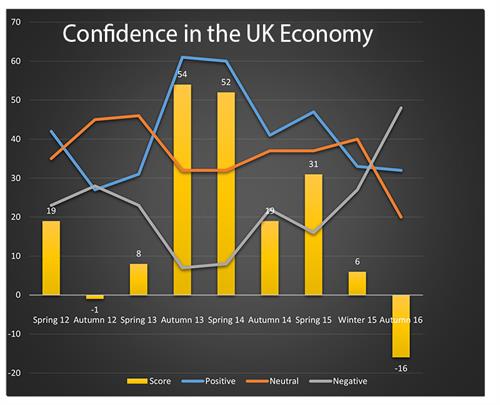

Of over 600 respondents to the CISI’s online survey, 48% were less optimistic about the outlook for the UK than ten months ago, while 32% felt more optimistic with 20% unchanged. The CISI confidence indicator (sum of positives less sum of negatives) was -16% compared to 6% in January 2016.

The survey was conducted from 25 August-22 November 2016. There were 58 comments left by respondents, 63% of which contained the word “Brexit”.

Other concerns raised included the drop in the value of sterling, passporting implications, quantitative easing and Article 50. Comments included:

Simon Culhane, Chartered FCSI and CISI Chief Executive said: “There is no denying that Brexit has affected the industry’s confidence in the UK economy, generating concerns in particular on the issues of passporting and the drop in sterling. The outcome of -16% for confidence is low. The recent result of the US Presidential election as a factor has hardly been mentioned by respondents but it may be too soon to for the effect of this result to come through in market sentiment.”

Simon Culhane, Chartered FCSI and CISI Chief Executive said: “There is no denying that Brexit has affected the industry’s confidence in the UK economy, generating concerns in particular on the issues of passporting and the drop in sterling. The outcome of -16% for confidence is low. The recent result of the US Presidential election as a factor has hardly been mentioned by respondents but it may be too soon to for the effect of this result to come through in market sentiment.”

Respondents were asked to compare how they felt about the UK economy six months ago. The last time the CISI survey reflected a negative outcome was in autumn 2012 when the comparative figure was -1%.

The CISI has conducted the poll every six months since spring 2012, with the current figure reflecting economic confidence during a ten month period. The confidence level expressed peaked in autumn 2013, with a sum total of 54%.