The FCA’s judgment on ex-Blackrock Managing Director, Jonathan Burrows was grossly disproportionate and sends out the wrong message, says Simon Culhane, Chartered FCSI and CEO of the Chartered Institute for Securities & Investment (CISI).

In the 40,000 strong membership body magazine, Securities & Investment Review editorial, Mr Culhane discusses the case of Mr Burrows, who was banned for life by the FCA from working in the financial services industry as a result of him avoiding his full train fare over 5 years.

“It marks the first time that the UK central regulator has taken action against an individual solely on account of that person’s behavior in their personal life.

“The regulator was absolutely right to call Mr Burrows to account and to publicly make it clear that financial services professionals cannot pick and choose when they behave ethically,” says Mr Culhane.

Although Burrows was not a CISI member, Mr Culhane points out that CISI members are well aware of the importance of adhering to the CISI’s Code of Conduct at all times, including Principle 8 which states members should “strive to uphold the highest personal and professional standards”. Mr Culhane says of upholding the Code : “It’s a 24/7 obligation, not a 9-5 option.”

But as Burrows’ action had no affect on either the financial system, the market nor any direct effect or influence on clients or counterparties, a period of suspension from working in the financial services sector would have been a more proportionate sanction.

“Normal legal convention discounts any penalty if the individual or firm owns up and cooperates – which Mr Burrows did. In these cases the FCA normally applies a 30% reduction.

“So what happened here? Why hasn’t the FCA been consistent and applied its policy in this case?

The penalty, says Mr Culhane, is more draconian than those handed to the LIBOR or interest-rate fixers, or those who peddled the toxic PPI products or precipice bonds. It is more penal than those handed out to chief executives, NEDs and chairmen whose lack of judgment cost many billions of pounds.

“Mr Burrows’ case attracted considerable media interest, with the tabloids picking up the story over the summer and replaying it regularly; baying for blood with greater intensity and hysteria each time it was recycled.

“Against this background, it was absolutely right for the FCA to take action. However, the FCA was wrong in its disproportionate response, which has the whiff of playing to the court of mob rule and lacking in fairness – a key ingredient of behaving with integrity”, said Mr Culhane.

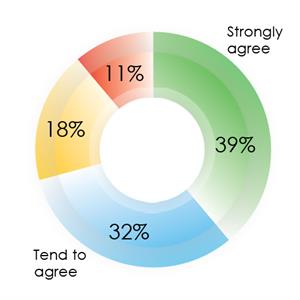

The CISI’s latest members’ survey asking if respondents agreed with the following statement: “The FCA is right to discipline individuals for failings in their private life” found that 71% of respondents either strongly agree or tended to agree. Only 11% strongly disagreed that the FCA is right to discipline individuals for failings in their private life.

The CISI’s latest members’ survey asking if respondents agreed with the following statement: “The FCA is right to discipline individuals for failings in their private life” found that 71% of respondents either strongly agree or tended to agree. Only 11% strongly disagreed that the FCA is right to discipline individuals for failings in their private life.

However, the comments left by respondents paint a more complicated picture. Whilst many of the commenters noted that professionals should act with integrity at all times – including in their private life – and that the nature of Burrows’ offence meant that he could not be considered ‘fit and proper’ or trusted with other people’s money, there were also several questions regarding the proportionality of the FCA ban.

Comments were left about the absence of any potential for ‘rehabilitation’, and one commenter noted “I agreed that [Mr Burrows’] integrity was called into question... he should be punished by the FCA and law, but his ban from performing any function in relation to regulated activities seems too much.”

Another commenter explained the reason behind feeling this way: “After a suitable redress for failure, all people should be given a second chance. Not to do so denies redemption as everyone fails from time to time.”